R&D Tax Claims: Automated, Defensible, Fast

Not another advisor.

AI-native platform for tech companies to turn your data into defensible review-ready R&D tax relief claims — in days, not months

Backed by

Taxnova is an AI platform that automates R&D tax relief for tech companies by turning engineering and finance data into audit-defensible maximised claims – without guesswork, manual interviews, or time-wasting data collection.

Taxnova

Trusted by modern

tech teams

Used by tech companies who care about

fast delivery, evidence quality, and high-grade defensibility

Who Taxnova Is Built For

Finance Leaders

CFO, Finance Director, Head of

Finance/Tax, Financial ControllerYou are accountable for claim quality, compliance risk, and cash impact

Your reality today

Claims take months of internal coordination

Evidence quality depends on retrospection and interviews, and advisor knowledge in the subject

R&D tax is accrued using estimates, leading to painful restatements when final numbers emerge months after year-end

Enquiry risk feels asymmetric and personal

Manual processes cause underclaiming with projects missed and geographies excluded

How Taxnova helps

Produces structured, traceable, enquiry-ready documentation

Removes dependency on interviews and manual data chasing

Gives visibility into the accumulated R&D tax claim amount throughout the year

Fits alongside your existing advisor or internal tax team

Captures all eligible projects and geographies

The problem with R&D tax relief today

R&D tax relief takes months to prepare

R&D tax claims are tackled months after delivery, requiring teams to reconstruct work manually when key contributors may no longer be available

Finance teams rely heavily on engineers

Most advisors lack direct access to primary source data and depend on time consuming interviews with engineering and product teams

Audit scrutiny feels riskier every year

The compliance bar keeps rising, while the underlying R&D claim process remains outdated and manual

Companies leave eligible R&D unclaimed

Identifying all qualifying projects and contributors retrospectively is slow and resource-intensive

The Taxnova way

Automation first, expert review where it matters

Evidence grounded in primary source systems

Structured outputs built for enquiry defence

Designed to complement advisors, not replace them

Why We Built Taxnova

R&D tax relief is now a data problem, not a consulting problem.

Taxnova replaces ad-hoc, interview-driven workflows with a repeatable, auditable, productised process designed to withstand the latest compliance requirements.

What Makes Taxnova Different

This is R&D tax relief as infrastructure to power your innovation funding claims — not a one-off engagement.

How Taxnova

R&D tax relief

automation work

Connect Your Data

1Securely connect engineering and finance systems already in use.

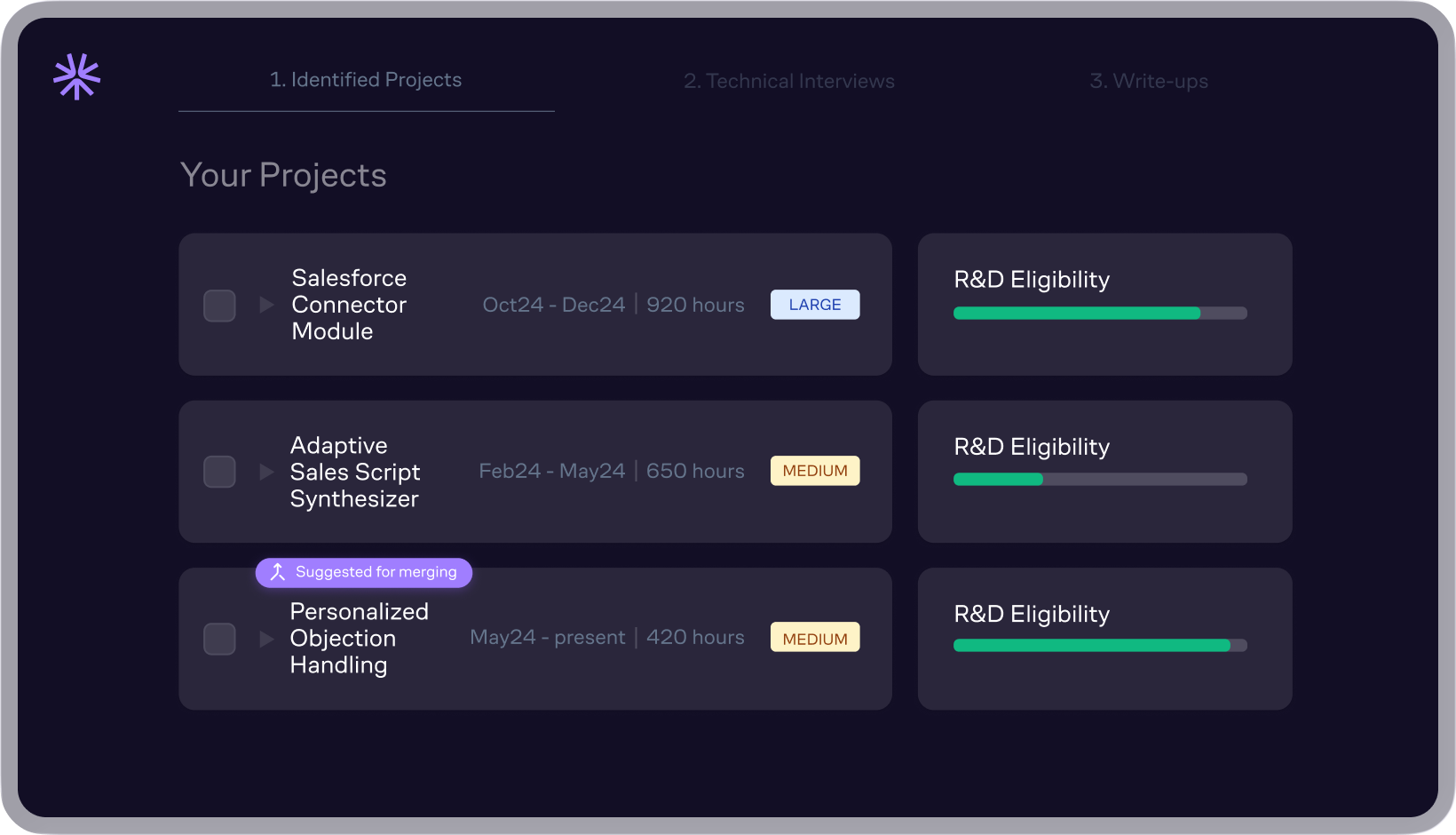

Automated R&D Analysis

2Taxnova identifies eligible projects, contributors, and activities using consistent qualification logic accounting for the tax authorities guidelines.

Evidence-Linked Documentation

3Technical narratives and R&D percentages are generated with direct links to underlying evidence.

Review & Submission

4The engineering team confirms the output and adds indirect activities if needed. Your advisor or internal tax team reviews, finalises, and submits the final claim report.

Integrations & data sources

Taxnova fits naturally into modern tech stacks you already run

Engineering & Delivery

Jira, Linear

GitHub, GitLab, Bitbucket

Azure DevOps

Finance & Accounting

Confluence

Notion

Google Docs

HR & Payroll

Slack

ERP

Xero, Quickbooks

NetSuite

Outcomes for finance & engineering teams

Taxnova enables repeatable, year-over-year claims without restarting the process from scratch

Speed

Claim preparation reduced from 6 months to 2 weeks

Effort Reduction

80%+ less internal admin and interview time

Compliance Confidence

Clear audit trail aligned with tax authorities expectations

Financial Impact

Improved detection of eligible work – companies see on average +10% of eligible expense

Trust, Security & Compliance

Taxnova is infrastructure you can stand behind in front of auditors, boards, and regulators

Built for enquiry readiness

Evidence-linked, reviewable outputs

Clear jurisdictional handling

Designed for enterprise security reviews

SOC 2 and ISO 27001 readiness in progress

Why companies

choose Taxnova

Data sources

Data collection effort

Risk of underclaiming

Evidence & traceability

Speed to draft claim

Enquiry support

Traditional advisor-led process

Interviews, workshops, memory-based summaries

Manual and slow, driven by repeated interviews

Depends on what surfaces in interviews

Selective evidence, hard to reconstruct later

3–6 months

Manual digging, often back to engineers

In-house attempts

Internal spreadsheets and ad-hoc exports

Semi-automated but highly disruptive internally

Depends on what surfaces in conversations

Inconsistent and fragile

2–4 months

Largely unsupported

Direct connection to Jira, GitHub, docs, tickets and payroll data

Automated ingestion with minimal targeted follow-ups

Systematic detection across teams, projects and geographies

Every claim tied back to source evidence

Days to weeks

Answers instantly surfaced from linked data, with optional advisor review

Frequently asked

questions

Does Taxnova increase HMRC enquiry risk?

+

No. Taxnova is designed to reduce enquiry risk by improving evidence quality, traceability, and narrative consistency

Do engineers need to be heavily involved?

+

No. Most evidence is collected automatically. Engineers only answer targeted, contextual questions when needed

Is Taxnova a replacement for our advisor?

+

No. Taxnova complements advisors by handling the heavy lifting and improving claim quality

How long does a typical claim take with Taxnova?

+

From days for smaller companies to around 2 weeks for larger organisations

Which countries does the tool cover right now?

+

Live in the UK and fully HMRC-compliant. US support is launching soon, with more countries following in 2026

How is data security handled?

+

All work under NDA, EU-based Google Cloud, no source code or live system access, and data anonymised after completion, SOC2 certification in process

How does Taxnova handle cloud and software costs?

+

We scan your ledger to surface potentially eligible costs; you retain control over assigning the final R&D percentage

How does Taxnova deal with legislative changes in R&D tax regulation?

+

We continuously track regulation updates and keep the AI aligned to the correct rules for each accounting year

What does onboarding look like?

+

Secure data sharing via exports or read-only API keys; no code access required. Setup takes ~1 hour of your time

About us

CEO & CFO

Ex Product Lead @ Gett Managed & launched all B2B tech products; felt pain firsthand running R&D tax claim

CTO

Research and Engineering Delivered B2B fintech projects & AI PoCs for tier-1 clients at Criteo | 1K-engineer org

seasoned tax advisors

Some of the most experienced R&D tax specialists are our advisors

CFOs & CTOs

Finance and Engineering leaders from tech companies such as Miro are our investors

Get started

with Taxnova

If R&D tax claim feels risky, slow, or disruptive — it doesn’t have to be

Taxnova gives finance and engineering teams a faster, safer, and more controlled way to claim what they’re entitled to